$1,400 Stimulus Check Question: Can the IRS Can Ask for the Money Back?

The endeavor to fast-track $1,400 stimulus payments led to some of those checks ended up heading into the bank accounts or mailboxes of deceased individuals.

‘’Amid another hectic tax season, the Internal Revenue Service and the Treasury Department surely have been working overtime in getting millions of coronavirus stimulus checks into the hands of financially struggling Americans.

And in that endeavor to fast-track these $1,400 stimulus payments, some of those checks ended up heading into the bank accounts or mailboxes of deceased individuals.

In such an unfortunate situation, the IRS has given notice that spouses or relatives will need to make time to return the stimulus payments to the agency.

However, be aware that this notice only affects U.S. taxpayers who died before January 1, 2021—and know that the extra $1,400 per dependent is also not to be spent for a parent who died before that date.

Moreover, if the deceased spouse was part of a joint return, the surviving individual can keep the cash. The same holds true if a person who died is a married member of the U.S. military.

If a stimulus check has both the husband and wife’s names, he or she is eligible to keep the funds but must include a letter requesting a new stimulus payment be reissued with only the surviving spouse’s name on it.

To return the funds, they should write “void” in the endorsement section on the back of the check and then mail it to a local IRS location. If one decides on this route, they should also write a brief explanation stating the reason for returning the stimulus check.

If the payment was already directly deposited into a bank account, then one can mail off a personal check or money order to an appropriate IRS location. Make the check payable to “U.S. Treasury” and write “Third EIP” and personal taxpayer identification number (social security number or individual taxpayer identification number) on the check.

Keep in mind that according to the law office of Stechschulte Nell, one should think twice before trying to deposit a stimulus check that’s not rightfully theirs.

“If you have tried to deposit a dead or fraudulent COVID-19 stimulus check you may be charged with a federal crime such as bank fraud, mail fraud, or wire fraud. All of these are serious crimes, with long sentences of imprisonment or large fines,” the law office wrote.

“In some cases people have been defrauded of their stimulus check, and when they try to deposit what they think is their real money, they may find that they have been a victim of a scam. Even though they are the victim, they may nonetheless be charged with a crime. Regardless of why you have been charged with fraud, you need to contact an attorney as soon as possible,” it added.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn.

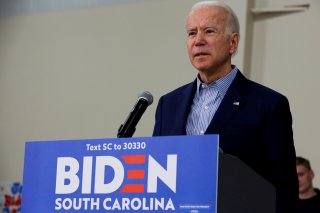

Image: Reuters