Haven't Received Your Stimulus Check? Check Your Bank Account Soon.

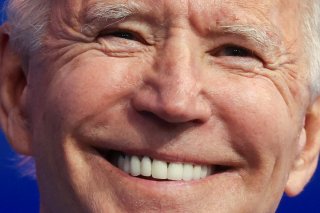

The Internal Revenue Service has reportedly sent out 159 million stimulus checks, worth $376 billion after Congress passed President Joe Biden’s $1.9 trillion coronavirus relief package. But did you get your money?

The Internal Revenue Service has reportedly sent out 159 million stimulus checks, worth $376 billion after Congress passed President Joe Biden’s $1.9 trillion coronavirus relief package.

Eligible Americans received up to $1,400 per adult in the latest round of relief, plus $1,400 per child or adult dependent. The direct payments were based on adjusted gross income, similar to the previous stimulus checks, with individuals earning up to $75,000, $112,500 as head of household, or $150,000 if married, and filing jointly receiving the full amount.

But Americans with adjusted gross income above $80,000 as a single filer, $120,000 as heads of households, and $160,000 for married couples would not qualify for the direct relief.

Although millions of stimulus payments have been pumped into the pockets of Americans by direct deposit, checks, and prepaid debit cards, more aid continues to go out. Here are some people who may still be waiting for the stimulus and are still eligible.

People who didn’t file taxes

The IRS is also sending the $1,400 stimulus checks to people who do not typically file taxes.

Even if you don’t regularly file tax returns, the agency is pushing Americans to submit taxes, so that they can receive the aid.

Homeless Individuals

The IRS indicated that even if you don’t have a permanent home address or bank account, you could still see the direct relief.

That could be homeless people, those who live in rural areas, as well as other underserved groups. The agency is pushing these groups to file tax returns, which can be completed on a smartphone or computer.

You may be able to have your direct payment expedited by opening a bank account with a low-or-no-cost financial institution by submitting the account’s routing number upon filing.

The IRS also offers an IRS Free File program that allows eligible users to file taxes for free.

Federal Beneficiaries

Americans who receive federal benefits like Social Security, Supplemental Security Income, Railroad Retirement or Veterans Affairs benefits, could still be waiting on the third direct payment, according to CNBC.

These types of beneficiaries don’t normally file taxes, but if they have dependents, the IRS is encouraging them to file a tax return to receive additional economic aid.

“Plus-up” Payments

Some Americans may even be eligible for extra payments.

The IRS has started sending out catch-up payments, or “plus-up” payments to Americans who are qualified for additional relief than what they received in the third stimulus check.

The agency used the latest tax return information on file to determine the payment amount for the most recent round of relief, which was the 2019 tax return for many Americans. However, many families saw a drop in income in 2020 due to the economic downturn triggered by the health crisis, which would make them eligible for additional aid.

Rachel Bucchino is a reporter at the National Interest. Her work has appeared in The Washington Post, U.S. News & World Report and The Hill.