The Case Against a Fourth Stimulus Check

It seems unlikely. For the most part, the economy is recovering on its own. It is easy to see why; to date, nearly 125 million Americans have been fully vaccinated. Businesses are re-opening and re-establishing their supply lines, and Americans who have been cooped up for a year are increasingly spending money at them

Is a fourth stimulus check possible?

Two months after the American Rescue Plan Act was signed into law, the third round of stimulus payments are wrapping up. So far, 165 million payments have been made from the initial round of stimulus checks in March. This amount, plus the “plus-up” supplemental payments paid out to Americans, has so far amounted to a staggering $422 billion in direct cash relief.

But many want more. Some Democrats have seized on the idea of $2000 monthly payments to all Americans for the remaining duration of the pandemic. Humanity Forward, a political group created by New York mayoral candidate and former presidential candidate Andrew Yang, has gathered the support of dozens of prominent Democrats for this proposal. And a Change.org petition to this effect has, since the time of its creation at the start of the pandemic, racked up more than two million signatures.

The case for a fourth stimulus check, however, rests on the idea that the money in question will “stimulate” the economy, increasing inflation, curbing job losses and allowing money to change hands. As of May 2021, though, it is not clear if the U.S. economy needs such stimulation.

To begin with, U.S. GDP had a growth rate of 6.4 percent last year – a solid increase. Although many physical jobs experienced problems, one consequence of the pandemic was the discovery that many white-collar jobs are just as easily completed on Zoom than in an office.

Moreover, because many outlets for spending – restaurants, bars, movie theaters, and other entertainment venues – were closed during the pandemic, many Americans actually saved money during the lockdowns. In April 2021, the personal saving rate stood at 27.6 percent, not as high as the 33.7 percent rate in April 2020 but still well above pre-pandemic rates.

The markets have also done well during the pandemic. Inflation remains high; in 2021, prices rose roughly 4.4 percent, almost double the increase from 2019, before the pandemic. While some of this increase is likely due to the effects of depressed prices from 2020, this once again indicates that prices are returning to normal already, without the aid of expansive stimulus measures.

Taken together, all of this suggests that, for the most part, the economy is recovering on its own. It is easy to see why; to date, nearly 125 million Americans have been fully vaccinated. Businesses are re-opening and re-establishing their supply lines, and Americans who have been cooped up for a year are increasingly spending money at them.

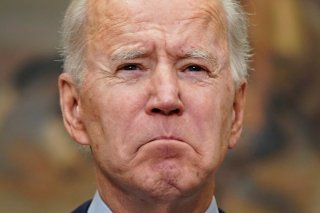

This is not to suggest that everything is perfect. In particular, the pandemic has highlighted a gulf between blue-collar “essential workers” and those who could work from the safety of home. High rates of unemployment among the former have dented economic recovery, and financial insecurity is still rampant. Certainly, there are appropriate measures that the Biden administration could take to address their needs. However, considering the localized needs of these people, a blanket cash payment to all working Americans might not be an efficient solution.

Trevor Filseth is a news reporter and writer at the National Interest.