Americans Want Child Tax Credit To Be Fully Refundable, New Poll Says

A survey conducted by Hill-HarrisX found that 51 percent of participants said that the credit should be fully refundable.

Here's What You Need to Know: The IRS and Treasury Department are expected to begin distributing the child tax credit on a monthly basis beginning July 15.

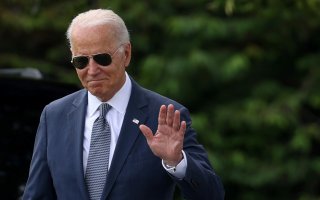

Aslim majority of Americans said that the federal child tax credit from President Joe Biden’s coronavirus relief bill should be made fully refundable, according to a new poll.

The survey, conducted by Hill-HarrisX, found that 51 percent of participants said that the credit should be fully refundable.

About 54 percent of respondents said that they oppose boosting the amount of the child tax credit, and 53 percent said they oppose sending monthly payments scheduled through the end of the year and the rest of the credit when filing 2021 taxes in 2022.

Biden’s $1.9 trillion American Rescue Plan boosted the child tax credit from $2,000 to $3,000 and allowed parents with children under the age of six to qualify for $3,600. The measure also permits parents of children at the age of seventeen to be eligible for the credit.

Parents with children under the age of six will get $300 monthly payments per child from July through December, and those with children between the ages of six and seventeen will receive $250 payments per child. The rest of the money can be claimed when they file taxes next year.

Recipients, however, can opt-out of the monthly payments and receive the credit in one lump sum.

Similar to the qualifications for the stimulus checks from Biden’s relief bill, individuals earning up to $75,000 are eligible for the full enhanced credit amount, as well as joint filers making up to $150,000 and heads of households earning up to $112,500. The amount will then drop by $50 for each $1,000 in income above these caps.

The IRS determined child tax credit eligibility based on 2019 and 2020 tax returns, but families can update information like income marital status and the number of dependents through an online portal.

Roughly 44 percent of participants in the poll said that some families who are eligible to receive the child tax credit don’t need it, while 30 percent said some families who are not eligible for the credit do need it. Nearly one-fourth of surveyors said the credit is going to exactly the parents who need it.

The IRS and Treasury Department are expected to begin distributing the child tax credit on a monthly basis beginning July 15, followed by August 13, September 15, October 15, November 15 and December 15.

The Hill-HarrisX poll was conducted online from June 7 to 9 and surveyed 839 registered voters. It has a margin of error of plus or minus 3.18 percentage points.

Rachel Bucchino is a reporter at the National Interest. Her work has appeared in The Washington Post, U.S. News & World Report and The Hill.

This article first appeared earlier this month.

Image: Reuters