Did Joe Lie? Why Biden Hasn’t Jumped on Canceling Student Debt

The interest rates on nearly all federal student loans have been adjusted to zero through September to alleviate the debt burden amid an economic crisis.

Here's What You Need to Remember: Biden has expressed interest in canceling up to $10,000 in federal debt per borrower, but several Democrats are pushing for the White House to forgive as much as $50,000 for each borrower.

Interest rates on federal student loans for the upcoming academic year will rise after several years of decreasing, according to a new analysis.

Although interest rates will increase, higher education expert Mark Kantrowitz, who conducted the analysis, said that the rates still remain historically low. And while the Education Department hasn’t released the interest rates for students attending college in the fall, Kantrowitz estimated that the rate for direct loans for undergraduates will jump to 3.73 percent from 2.75 percent.

“It is the fourth-lowest interest rate in the last decade,” he said.

That interest rate boost will hike monthly payments on a 10-year loan to $99.99 from $95.91 for every $10,000 borrowed, according to Kantrowitz.

Kantrowitz also expects that Stafford loans for graduate students will rise to a 5.284 percent interest rate, which currently remains at 4.2 percent. This spike would increase monthly payments on a 10-year loan to $107.46 from $102.68 for every $10,000 borrowed, CNBC reported.

The expert also estimates that students who plan to take out PLUS loans will see an interest rate of 6.284 percent, a nearly one-percent hike after sitting at 5.3 percent for the last academic year. That would put monthly payments on a 10-year repayment term to $112.45 from $107.54 for every $10,000 borrowed, CNBC reported.

Those who take out federal student loans after July 1, 2021 will see the increased rates.

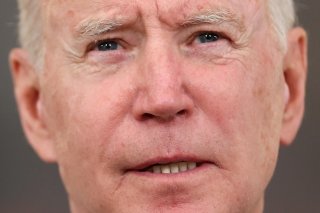

Kantrowitz’s findings come as congressional Democrats and education advocacy groups have called on President Joe Biden to implement a widespread student loan cancellation measure.

Biden has expressed interest in canceling up to $10,000 in federal debt per borrower, but several Democrats are pushing for the White House to forgive as much as $50,000 for each borrower.

But the president has previously asked Education Secretary Miguel Cardona to put together a memo on the president’s “legal authority” to cancel up to $50,000 in federal student loan debt through executive order, which wouldn’t require Congress’ approval, but the administration has reportedly not completed its review of the president’s legal authorities.

In the meantime, the interest rates on nearly all federal student loans have been adjusted to zero through September to alleviate the debt burden amid an economic crisis that’s left millions of Americans unemployed and struggling to pay bills like food and rent.

Rachel Bucchino is a reporter at the National Interest. Her work has appeared in The Washington Post, U.S. News & World Report and The Hill. This article first appeared earlier this year.

Image: Reuters.