Starting July 15, the IRS Is Sending Out Monthly Stimulus Check

The first advance payment of the Child Tax Credit – worth either $250 or $300 per child, depending on the child’s age – is set to be sent out on July 15.

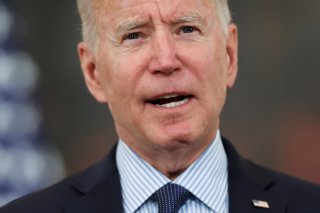

Here's What You Need to Remember: Ordinarily, the Child Tax Credit is considered a tax discount at the end of the year; the amount – historically $2000 per child per year – is counted as a rebate against existing taxes. Following President Biden’s American Rescue Plan Act, this structure changed; the credit was increased to $3000 or $3600 per year, depending on the child’s age, and half of it was slated to be sent out early,

The first advance payment of the Child Tax Credit – worth either $250 or $300 per child, depending on the child’s age – is set to be sent out on July 15.

The IRS indicated that it would open a pair of online portals to handle issues surrounding the payments. So far, the first portal, primarily intended for regular tax filers, remains closed; but the second portal, primarily intended for parents who do not normally file tax returns and for whom the IRS might be missing important information, has opened up on the IRS website.

The basic function of the portals, besides telling the IRS missing information, is to choose to opt out of the payments. Ordinarily, the Child Tax Credit is considered a tax discount at the end of the year; the amount – historically $2000 per child per year – is counted as a rebate against existing taxes. Following President Biden’s American Rescue Plan Act, this structure changed; the credit was increased to $3000 or $3600 per year, depending on the child’s age, and half of it was slated to be sent out early, in the form of monthly checks from July until December. The first such check will arrive shortly after July 15.

Ordinarily, it is advisable to take money when it is received, rather than to sit on it until your taxes are filed in April 2022. However, this is not always convenient. Families expecting another child before April 2022 may find it more useful to simply claim for all of them in April, rather than dealing with the hassle of completing paperwork beforehand. Additionally, unlike stimulus checks, Child Income Tax payments are not tax-deductible, meaning that a certain amount of them must be set aside for the IRS; rather than spending the amount now and waiting to pay the bill in April, some families will probably find it more convenient simply to take the lump sum then.

Finally, and perhaps most significantly, the people for whom the second portal is designed do not regularly file taxes, making it more difficult for them to collect the rebate in April.

To use the nonfiler tool, you must have a primary residence in the United States for more than half of the year. You should also have an email address and a Social Security number. Having these, the IRS provides a helpful form assisting you in filling out the portal. Create an account, do so, and from there, you should be able to decline the advance checks.

Trevor Filseth is a current and foreign affairs writer at the National Interest. This article first appeared earlier this year.

Image: Reuters.