Does International Trade Actually Breed Conflict?

Contrary to traditional wisdom, international trade integration of countries found across political divides may lead to an unbalanced world and conflict due to resentment and fear.

The war in Ukraine has revealed an amazing paradox: nations can be at war while still trading with each other. Between the beginning of the war on February 24 and June 1, 2022, the European Union paid Russia 60 billion euros for fossil fuel deliveries only, while the Russian Federation was waging a savage war against a EU de facto ally, Ukraine.

Yet, the paradox of trading while fighting is not the product of hypocrisy or a cruel joke of the gods. It reveals an unexpected facet of economic globalization: the more it integrates nations, the more it creates the premises for conflict. The paradox did not become apparent until now because common and received wisdom claimed that economic integration leads to political convergence. However, for this to be true, the nations caught up in the process of globalization should have been close enough to converge. When they were at the polar opposite ends of the political spectrum, the results turned out to be disastrous. Autocracy and democracy pushed toward each other will end up clashing, not making peace.

The current European conflict is not the only one we can and should expect from forcing economic globalization onto nations that are too different to integrate with each other peacefully. Across the Pacific, the United States keeps importing hundreds of billions of dollars in commodities from a resurgent China that uses the proceeds to militarize the South China Sea and to create strategic outposts on Pacific islands, such as Guadalcanal and Tarawa, which cost the United States the lives of thousands of Marines and sailors to wrestle from the hands of Japan seventy years ago.

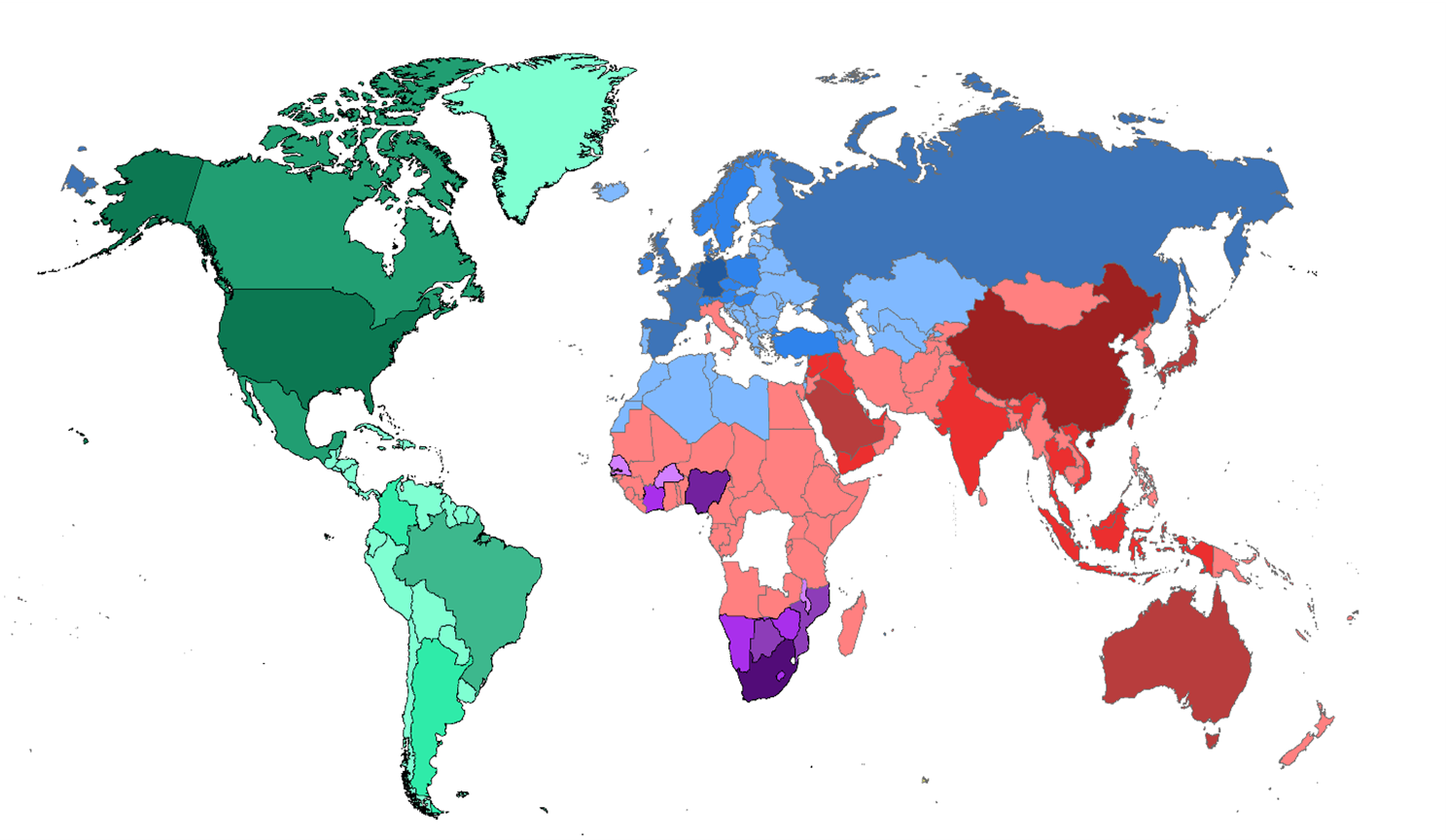

The “trade dependency-breeds-conflict” paradox was fueled not only by mere bilateral trade, but most importantly by the emergence of two trade blocks that decoupled the Western and democratic powers (United States, European Union, and the allied East Asian nations) from each other. For the first time, the United States and EU find themselves separated from each other and shackled to their main competitors. Research conducted by the FORCES initiative and the Krach Institute for Tech Diplomacy at Purdue University discovered vast co-dependency relationships across political blocks by analyzing the network of international trade data. We analyzed data collected in 2014 by the Global Trade Analysis Center at Purdue University. We found that China and the United States anchor an Indo-Pacific-African trade block (depicted in Figure 1 in red) that is distinct from the Eurasian one (marked blue), which relies on the leading EU nations, especially Germany, and Russia. In effect, the Atlantic political compact represented by NATO is undermined by the fact that it straddles a two-block trade map that rips the Western nations apart from each other.

Figure 1. Trade blocks revealed by network analysis of export-import flows between the 141 largest nations of the world. Two blocks have emerged, one anchored by the United States and China (red) and one by the EU and Russia (blue). Yellow nations are unaffiliated.

We discovered this misalignment by analyzing the trade relationships of 141 major nations representing over 95 percent of the world population and economic activity. We constructed a matrix of trade, which reflected how much each nation traded with the other 140 before the pandemic (2014). We then used network analysis to find communities or clusters of trade. The analysis grouped countries into network clusters or blocks in such a way that the average amount a nation trades with the members of its cluster is lower than the average of its trade to nations outside its cluster.

The main finding is stark. There are only two main trade blocks or sub-networks, the red (Indo-Pacific-African) and the blue (Eurasian). The yellow nations are “orphans” who belong to neither group and only sporadically trade with each other. In each block, a major Western power is shackled by strong trading links to an authoritarian regime. For instance, the United States is bound to China and the European Union to Russia and its dependencies.

Figure 2. Trade blocks defined by export-imports in electronics.

In a follow-up analysis, we also looked at the trade in electronics, including parts (semiconductors, peripherals, sensors, etc.) and integrated systems (computers, networks, etc.). The two paradoxical blocks remain, with the only difference that the red, Indo-Pacific block also includes Latin America, while the EU weight in the Eurasian block is heavier than it was in the overall trade map.

The presence of trade blocks is not surprising. What is truly unexpected is that the dividing line between the blocks creates a cleft right down the middle of the traditional Western system of alliances and dependencies. The fact that Germany and Russia are closer to each other than Germany is to the United States, and that the United States finds itself closer to China than to its European allies, goes a long way to explain current and potential future conflicts. Germany and the EU’s general hesitancy in tackling the Russian threat, both before and after the outbreak of the war in Ukraine, can only be explained by the fact that the EU found itself dealing with a problem for which it had no easy answer. The EU depends not only on Russian energy but has made significant long-term export bets on Russia and its former Soviet dependents’ markets in Central Asia. At the same time, the disconnection between the EU and the United States makes it hard for the two powers to support each other in time of need. Conversely, the initial U.S. hesitancy to tackle the Ukrainian problem is also a reflection of the fact that the United States recognized that the EU made its own plans, while the United States had to cope with its equally if not more complex entanglements with China across the Pacific.

The emergence of the two relatively unexpected trade blocks is the equivalent of a major tectonic shift of power which can lead to many more political and military earthquakes. These will be provoked by two factors. One, already mentioned, is the weakening of the Western political compact by the economic reorientation of the EU and the United States. The other exists within each of the newly formed economic blocks. The strong forces of economic attraction that push the EU toward Russia and the United States to China create the premises for even stronger rejection forces.

Why is the economic dependency created by the two blocks meant to create conflict? The answer is simple: economic dependency creates political resentment and existential fear. Economic integration demands political alignment and authoritarian nations can only accept that much adaptation before fearing a complete reversal of their current power arrangements and push violently back. Let us take the Russian-EU co-dependency. In Figure 1, not all blue colors are the same. Darker hues show the depth of the dependency of the nations on each other. Germany is the hyper-connector, being the darkest blue, followed by the second-tier great connectors: France, the United Kingdom, and Russia. In attacking Ukraine, Russia wanted to reassert its political importance in the Eurasian trade block rather than being absorbed into it. The fact that Ukraine aspired to be an EU member and that EU leaders wanted integration with Ukraine pushed Russia’s anxiety beyond the breaking point.

Otherwise put, the Europe’s tight economic embrace of Russia not only fueled the Russian military’s resurgence (with petro-euros reinvested by Russia in cruise missiles) but also the resentment that a successful expansion of the EU to the east might cut into Russia’s ability to be a true civilizational power.

Looking at the trans-Pacific (red) trade block, we notice that China and the United States are depicted in the darkest hues of red. They are thus the equally dependent on each other and the most important to the group. They are followed by Japan, India, Saudi Arabia, and then by the extended community of Southeast Asian nations, including Australia. The leaders of the red block, China and the United States, breed resentment with each dollar traded. The United States resents that China takes advantage of freer terms of trade to siphon intellectual property and illegally subsidize its state-controlled global economic leaders. China resents that the United States controls the world financial flows and the modern infrastructure of information, content, and finance.

Figure 3. Trade blocks resulted from removing the commerce between the US and China. China inherits the global trade block (red), while the US is pushed back to the Americas.

The co-dependent U.S.-China relationship has, however, an even deeper implication. The United States might need China to remain a leader in world trade more than China needs the United States. In a second step of our network analysis, we removed the link between the United States and China, as if the two countries were at war, ceasing all exports and imports. Figure 3 shows that China would remain in the Indo-Pacific trade block (red), strengthening its ties to the other nations and picking up new connections in Africa, while the United States will be sent back to the Americas, to form a new trade block (green) with its continental neighbors. In effect, a complete and sudden decoupling of the United States from China will send the United States back to the beginning of the twentieth century, turning it into a regional power. One hundred years of global dominance will end up back to Teddy Roosevelt’s aspirations to become a world power.