How Your Unemployment Tax Return Payment Could Suddenly Disappear

The refunds might never reach some Americans—or they might be in line for only a fraction of the original amount.

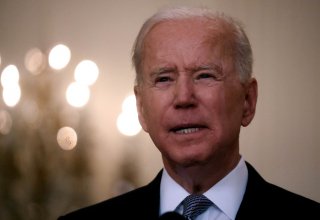

Here's What You Need to Remember: Approved via President Joe Biden’s $1.9 trillion American Rescue Plan, this newest cash windfall is from the waiving of federal tax on up to $10,200 of unemployment benefits—or $20,400 for married couples filing jointly—that were collected in 2020. According to the IRS, unemployment benefits are typically treated as taxable income.

Earlier this week, the Internal Revenue Service finally confirmed that the tax refunds on 2020 unemployment benefits will start heading out to eligible Americans’ bank accounts.

But be warned that the refunds might never reach some Americans—or they might be in line for only a fraction of the original amount.

This is due to the federal government having the legal means to use tax refunds to settle overdue debts, such as federal and state taxes, child support, and student loans.

Furthermore, the tax refund money could potentially be garnished by third-party creditors for unpaid private debts—such as overdue medical bills and credit card debts—once the funds are credited into a bank account.

Know that garnishment is a court order that allows for money to be removed from an individual’s bank account—and banks generally have to comply with a court’s demands.

Keep in mind that the same holds true for the current round of $1,400 coronavirus stimulus checks, as Congress frustrated many taxpayers when it failed to exempt the current stimulus money from garnishment. Washington did, however, approve garnishment protection measures for the $600 stimulus payments that were approved in December.

Still, even with the threat of tax refunds potentially being seized, the IRS noted that as many as ten million people likely overpaid on their unemployment taxes and could be in line for sizeable refunds.

A recent Treasury report confirmed that about 7.3 million tax returns already processed by the IRS appear to qualify for the tax refunds. “Of the 7.4 million tax returns, nearly 7.3 million—or 98.6 percent—had modified adjusted gross income of less than $150,000 and would likely qualify for the exclusion,” the report said.

Approved via President Joe Biden’s $1.9 trillion American Rescue Plan, this newest cash windfall is from the waiving of federal tax on up to $10,200 of unemployment benefits—or $20,400 for married couples filing jointly—that were collected in 2020. According to the IRS, unemployment benefits are typically treated as taxable income.

The agency added that for those who qualify for the refunds, the payments will be issued automatically.

“Because the change occurred after some people filed their taxes, the IRS will take steps in the spring and summer to make the appropriate change to their return, which may result in a refund,” the IRS said.

“Any resulting overpayment of tax will be either refunded or applied to other outstanding taxes owed,” it added.

Take note that married couples who file a joint tax return may have to wait longer than individual taxpayers to receive the refund—perhaps not until late summer. The IRS stated that this is because of the higher complexity of calculating their tax refunds.

Ethen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. Follow or contact him on LinkedIn. This article first appeared earlier this year.

Image: Reuters.