China Faces a Looming Economic Disaster

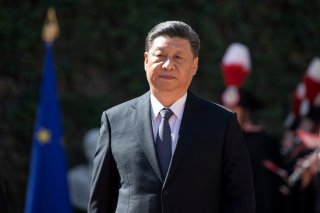

Xi’s decision to favor state capitalism has profoundly harmed China’s domestic and global economic growth.

A looming tsunami of Covid-19 infections is hurting the Chinese economy after the government abruptly announced it would end its harsh “zero-Covid” controls, prompting economists to warn that China could see a delayed recovery impacting both domestic demand and investment.

But China’s real trouble is that, as a result of the continuous crackdown on private and foreign-owned enterprises, its long-term economic growth faces challenges unseen since 1978, when Beijing launched economic reforms and pursued a strategy of opening up to global markets.

The difficulties mainly stem from the new brand of state capitalism that China has embraced since paramount leader Xi Jinping took office in 2012, which has seen the ruling Chinese Communist Party (CCP) tighten state control over economic and political resources by taking successive regulatory actions on a range of businesses. Enterprises are forced to follow the party’s demands instead of making independent, market-led decisions.

It is widely argued that the private sector has served as the main driver of economic growth since China embarked on market-oriented reforms in the 1980s. Data shows that the average returns of private investments are three times those of China’s state-owned enterprises. Despite the fact that the private economy in China now generates over 50 percent of total tax revenue, 60 percent of GDP, 70 percent of innovation, 80 percent of jobs in cities, and 90 percent of all registered companies, Xi still emphasizes the importance of ensuring that state-owned capital and enterprises are “built stronger, better and bigger.” State-owned enterprises (SOEs) are required to play a special role in providing public services, implementing government policies, and stabilizing the economy. At the same time, Xi has demanded that the government regulate and restrain private capital, preventing it from bringing immeasurable harm to economic and social development.

In recent years, the state has asserted greater control over the market and allocated more resources towards SOEs operating in strategically important areas, including semiconductors, artificial intelligence, life sciences, and renewable energy. Party cells are built in most of the big firms and are present in 92.4 percent of China’s top 500 private enterprises. Since 2020, the Chinese government has taken strong actions against the expansion of property developers, private education companies, technology firms, and other private enterprises, motivating more wealthy citizens to leave China.

Foreign investment in China, long a major source of technology transfer and capital influx, has declined steeply since Xi began enforcing unpredictable regulatory campaigns and the draconian zero-Covid policy in early 2020. Nearly a quarter of American and European corporations in China have already delayed or decreased investments. It is estimated that $300 billion in capital will flow out of China in 2022, up from $129 billion in 2021, as foreign companies lose interest in China and look to invest in Southeast Asia, India, and other business-friendly parts of the world.

In fact, Xi’s decision to favor state capitalism has profoundly harmed China’s domestic and global economic growth. Indeed, the World Bank slashed China's growth outlook to 2.7 percent in 2022, ranking it lower than the rest of the Asian-Pacific region for the first time in three decades. The world may be edging toward a global recession in 2023 due in part to China’s economic slowdown.

Another major impact on the economy is the fact that China's population is aging faster than almost all other countries in modern history. The enormous size of China’s cheap labor force was the decisive factor in its sharp economic expansion, but nearly 70 percent of Chinese businesses now face labor shortages, and 55 percent of companies are struggling to find blue-collar workers due to China’s demographic contraction.

Technological innovation is considered a major force in economic growth. Ongoing U.S.-China technological decoupling will cause China to lose innovation momentum, which is crucial to strengthening its competitive advantage. To break through the technology sanctions the United States is building, China is trying to increase self-reliance in science and technology and cut its dependence on the West. But in the context of globalization, a closed innovation system is inefficient. Indeed, China’s self-reliance strategy to counter America’s technological dominance is weakening its own long-term growth potential.

Based on his belief in the necessity of a strong party-dominated economy, Xi is enhancing the economic system of state capitalism. Recently, Beijing has rebooted the Mao-era state-run cooperative system, rolling out community canteens nationwide and setting up public-private joint-ventures, a clear sign that China is plotting a return to a centrally planned economy. China’s post-pandemic recovery will differ from that of other major economies. Recent measures to boost domestic demand and consumption can’t solve the deeply-rooted problems of inefficiency caused by state capitalism.

Long-term projections of Chinese economic growth have been reduced. The underlying trend suggests that China’s overall growth potential is likely to fall below 2.5 percent in the next decade. As a result, China will not overtake the United States as the world’s largest economy before 2030.

Chris Lee is a Chinese economist and political strategist. He has published more than 60 papers.

Image: Shutterstock.