Biden's $1.9 Trillion Dollar Stimulus Package: Who Wins? Who Lost?

The Biden administration and Democrats on Capitol Hill hope that the added funds being sent to families and middle-class Americans will encourage them to actively spend so that the economy can slowly bounce back to pre-pandemic behavior.

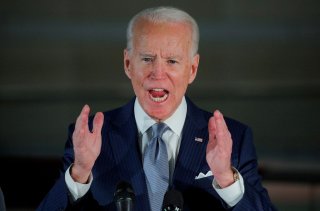

President Joe Biden signed his sweeping $1.9 trillion coronavirus relief bill into law on Thursday, ushering the administration’s first major legislative win, despite the lack of bipartisan support.

“This historic legislation is about rebuilding the backbone of this country and giving the people of this nation, working people, the middle-class folks, people who built the country a fighting chance,” Biden said.

The big-spending measure—which was signed one day early—will pump billions of dollars into the strained economy in the form of direct payments for many Americans, unemployment insurance, small business loans, state and local government aid, as well as funding for Covid-19 vaccine distribution and manufacturing to calm further spread of the deadly disease.

While Biden’s American Rescue Plan, dubbed “the United States’ most ambitious antipoverty initiative in a generation,” offers a load of perks for middle-class Americans and hard-hit industries, there are also plenty of disastrous provisions that are unrelated to tackling the coronavirus and pin a heavy financial burden on taxpayers.

But first, the relief bill does bring some economic recovery to middle-income households, as it offers direct checks of up to $1,400 for individuals making less than $75,000 and married couples earning less than $150,000, which is a tighter income threshold than previous rescue packages. Salaries beyond those see smaller stimulus payments.

The Tax Policy Center recently released a report that estimates that middle-income families earning $51,000 to $91,000 per year will see a 5.5 percent increase in their after-tax income due to Biden’s plan. But although the direct checks are more targeted, economists fear that the bill goes beyond what’s needed, as the payments may send thousands of dollars to families that have been financially unharmed from the pandemic.

Another middle-class victory is the expansive changes to the current tax policy that aims to help families with children. One major change is to the child tax credit, which now will be increased to as much as $3,600 for children under the age of six, up from $2,000 per child, and is $3,000 for children between the ages of six to seventeen.

The Biden administration and Democrats on Capitol Hill hope that the added funds being sent to families and middle-class Americans will encourage them to actively spend so that the economy can slowly bounce back to pre-pandemic behavior.

Another member of the economy—the restaurant industry—is among one of the few private-sector industries that won massive targeted relief as part of Biden’s plan. The package allocated $28.6 billion for a “revitalization fund” for restaurants that struggled during the pandemic. The fund intends to send out debt-free grants to help alleviate the financial cargo imposed by the public health crisis, with businesses eligible to receive up to $5 million each.

Restaurant groups, like the National Restaurant Association, have been lobbying for funds for the industry and pushed against the inclusion of the Democrats’ $15 federal minimum wage hike.

“No industry has lost more jobs and more revenue than restaurants,” Sean Kennedy, the National Restaurant Association’s vice president for public affairs, told The Washington Post. “We were the first industry to be shut down, we’ll be the last to reopen, and we have a very long road to recovery in front of us.”

While there are some clear winners to Biden’s rescue plan, experts warn that the bill lacks “targeted and temporary” policies that diminish the rapid spread of the virus and ultimately boosts the national debt, according to Matthew Dickerson, the Director of the Grover M. Hermann Center for the Federal Budget at the Heritage Foundation.

“The losers are the American taxpayers who will be forced to foot the bill for this liberal wish list that has very little to do with reducing the spread of the virus. Less than ten percent is dedicated [to] public health. The bill even spends less on vaccine distribution and COVID testing than it does to bail out mismanaged union pension plans,” Dickerson said.

He pointed to the legislation’s most expensive part, the $1,400 stimulus checks to most Americans, as they are largely being sent to those who haven’t experienced significant financial hardship over the last year, which is “not targeted aid,” Dickerson wrote in an op-ed published by the piece by the National Interest.

The bill also provides $126 billion to help reopen K-12 schools, but the non-partisan Congressional Budget Office estimates that only five percent will actually be used before 2022.

“How is that supposed to help reopen our schools?” Dickerson questioned.

He also referred to the larger issue that the package was purely partisan, unlike the previous legislations that were bipartisan efforts where both sides of the aisle “had to work together” to compromise.

The House passed the new round of Covid-19 relief in a starkly partisan 220–211 vote through budget reconciliation, a legislative procedure that avoids a GOP Senate filibuster and doesn’t require a single Republican vote.

For future legislation on things like infrastructure and climate change, it will be important to note how tightly the president clings to his commitment to being bipartisan, considering his first victory was the exact opposite.

Rachel Bucchino is a reporter at the National Interest. Her work has appeared in The Washington Post, U.S. News & World Report and The Hill.

Image: Reuters